Russian 🇷🇺 harvest moving very fast but wheat yields are roughly 10% lower yoy.

The Russian grain harvest is moving much faster than last year. Farmers have already harvested 13.7Mha compared to 5.5Mha a year earlier.

The gross wheat harvest is estimated at 40.7MT, which is 26.2MT more than last year. Wheat has already been harvested from 11.4Mha versus 3.7Mha at the same period last year! Average wheat yields are down 10%, from 3.9T/HA in 2023 to 3.5T/HA now.

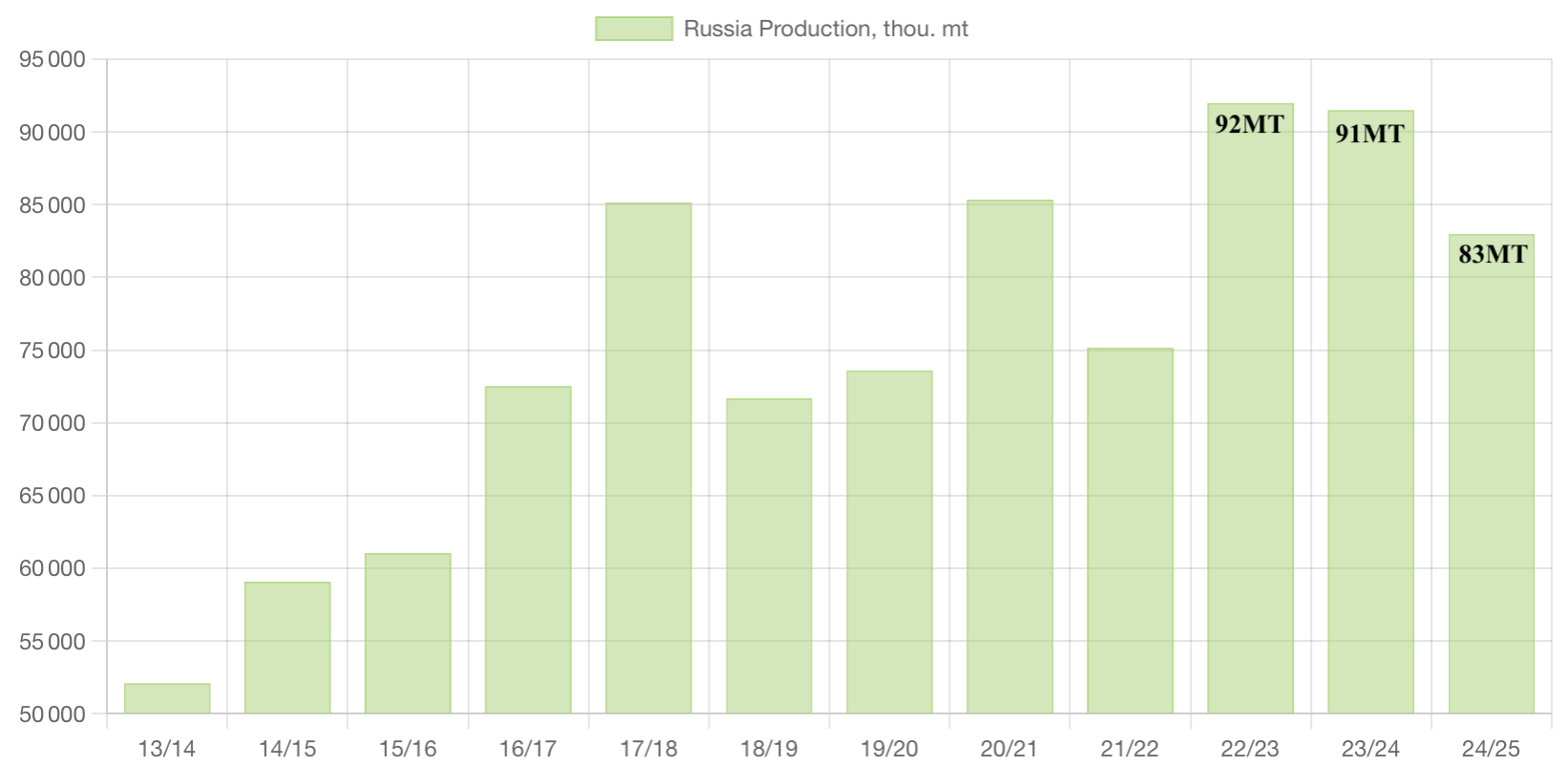

With more than half of the wheat harvested, we can confirm that the production will be down by 8 to 9MT. Quality seems to be also poorer. However, the fast harvest has triggered more pressure on prices at this early stage of the season.

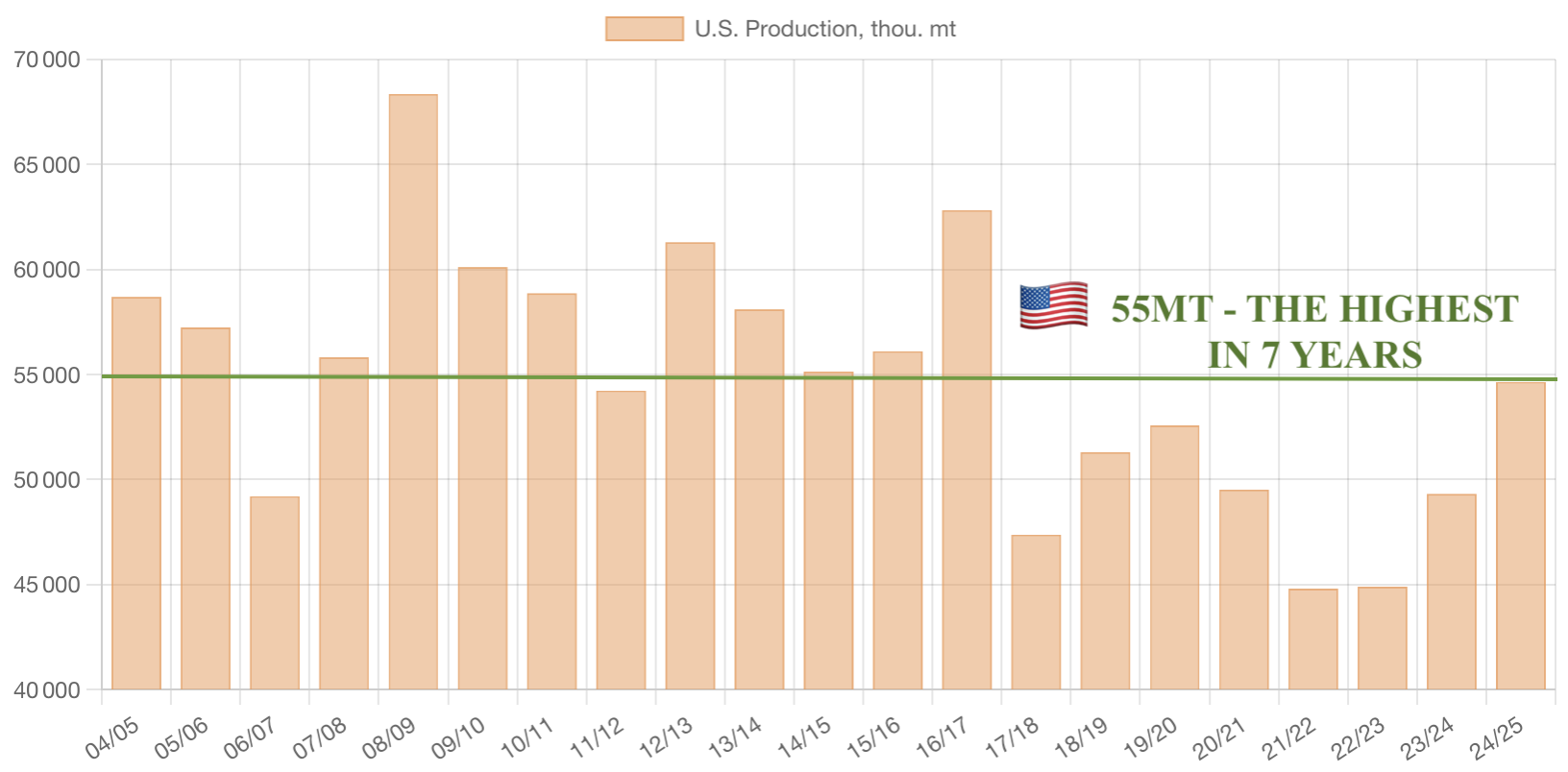

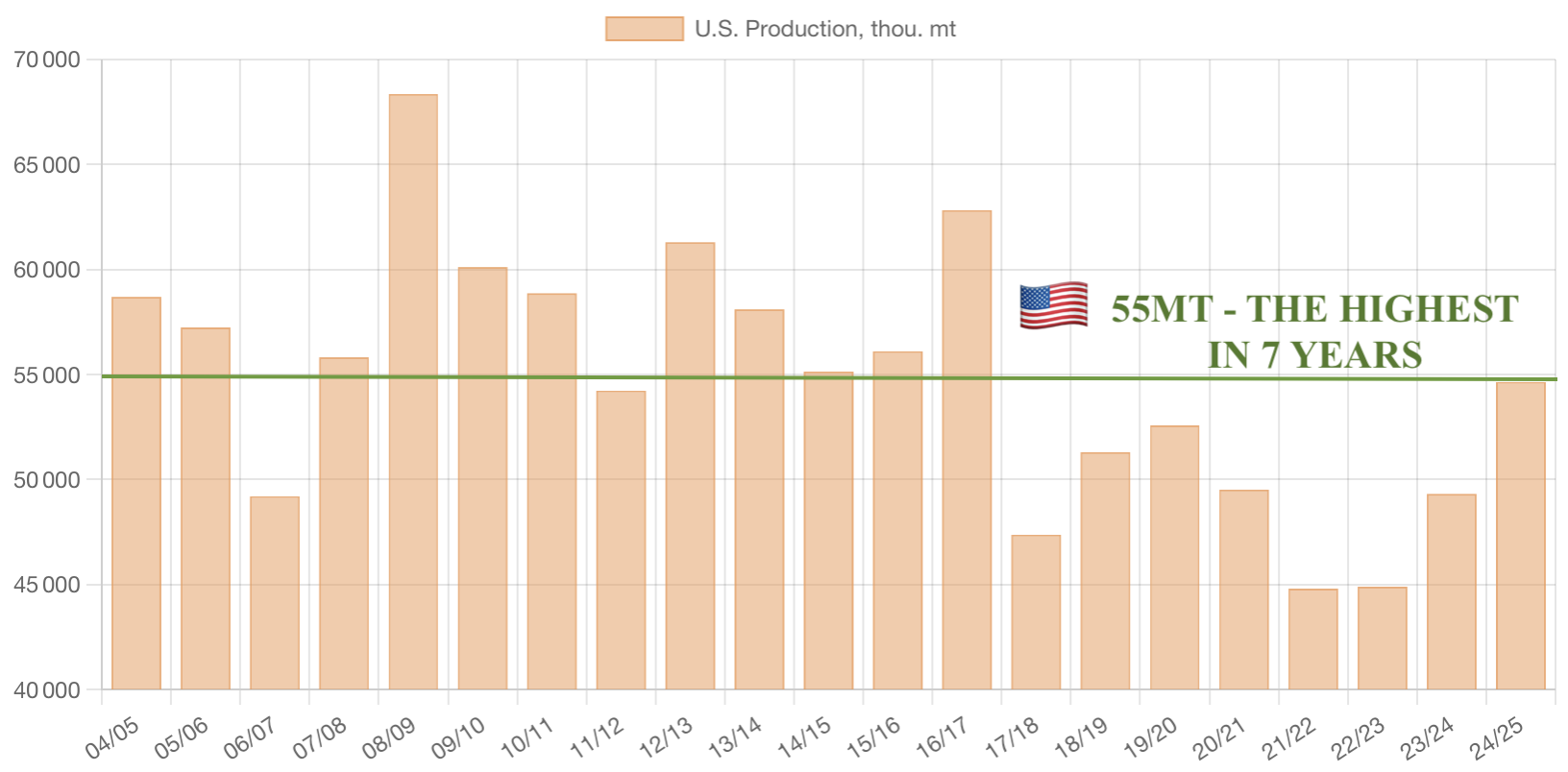

US 🇺🇸 wheat back on the world trade competition?

One of the main story for the wheat market this season is the resurgence of US exports in the world trade. Indeed, the US will produce the highest crop in 7 years and some 5MT more than last year. This surplus will have to reach new destinations such as North Africa, where we have not seen US competition for a while!

The US wheat crop size is thus bearish for our markets too!

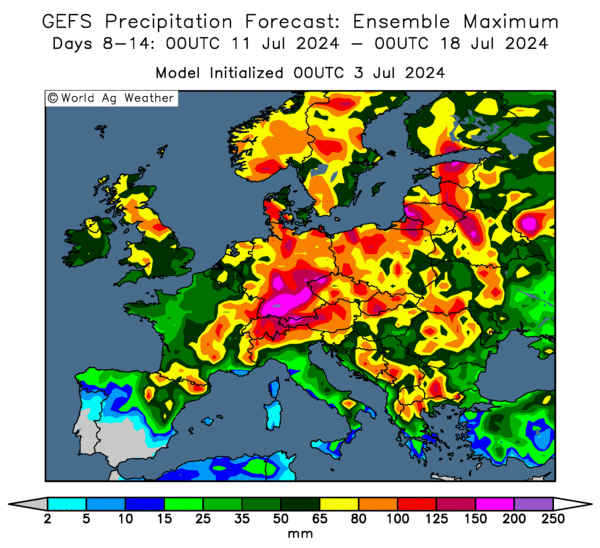

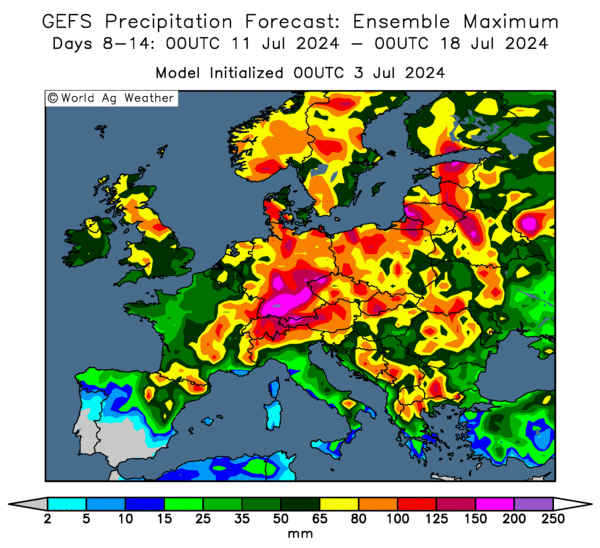

Very wet conditions in Europe 🇪🇺 as winter crops are ready for harvest.

The very first harvest results are disappointing in France, Poland, Germany, Czech Republic, Hungary and Slovakia especially for OSR and winter barley. Wheat is now getting ready for harvest but very wet conditions are in the forecast for next week.

At this stage, we thus confirm our pessimistic view on EU yields and qualities and we consider that prices could react positively. They already did for OSR. Wheat could follow as well as malting and milling premiums.

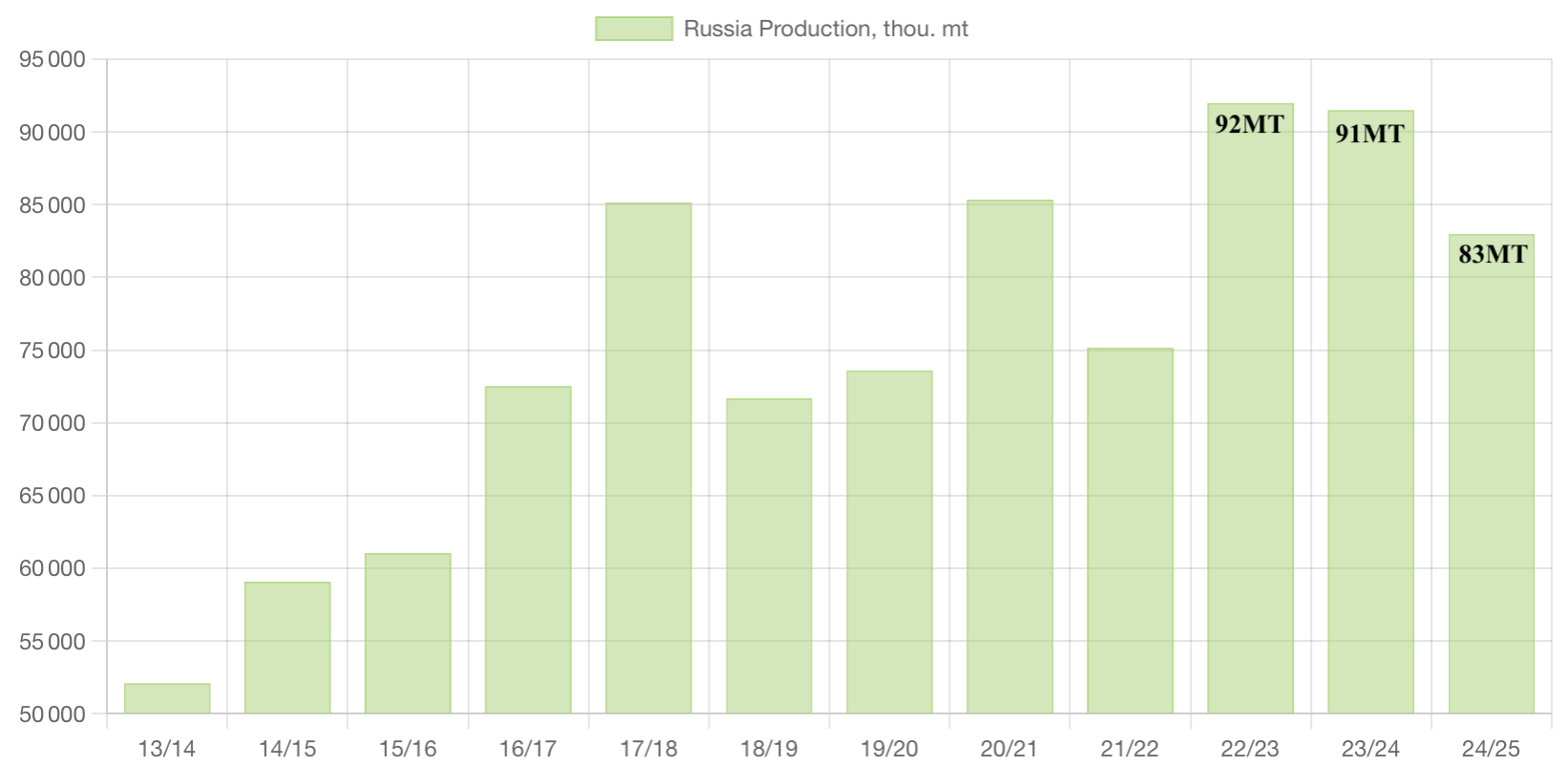

Sovecon RAISED their 2024 Russia 🇷🇺 wheat forecast to from 80.7MT to 84.1MT.

We were hearing better than expected yields in the South of Russia, ranging from 2T/HA (as expected) to 6T/HA (above expectation). As a result, a reliable analyst raised by 3.5MT their wheat production. It would still be 10MT down yoy.

Russian wheat prices have recently dipped below other origins again, as hot weather speeds up harvest there and traders compete with rival exporters from Ukraine, Bulgaria and Romania.

French wheat is trading some $15/T above these origins, capping any MATIF rebound attempt as here in the EU, production could well be very disappointing. Not the end of the wheat story yet!

Why is UK 🇬🇧 feed barley price so discounted to feed wheat?

New crop feed barley prices are trading at a -£35 discount to feed wheat, some £20 below the historical spread. This is due to a domestic situation, very simple to explain. On one side, the UK will need to import large volumes of wheat in 2024/25 to compensate our lower expected production. As such, UK wheat prices have to remain elevated to attract imports. That is the reason why LIFFE should be trading at parity or above MATIF. On the other side, the UK will remain a net exporter of feed barley. As such, UK barley prices have to remain low enough to be competitive on the export market, especially for Spain & Portugal. This is the reason why feed barley will remain discounted to feed wheat all along the season.

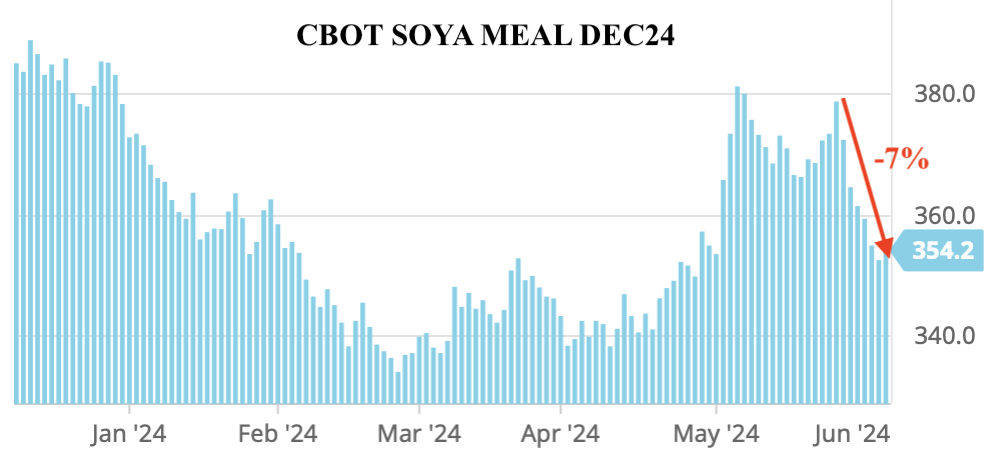

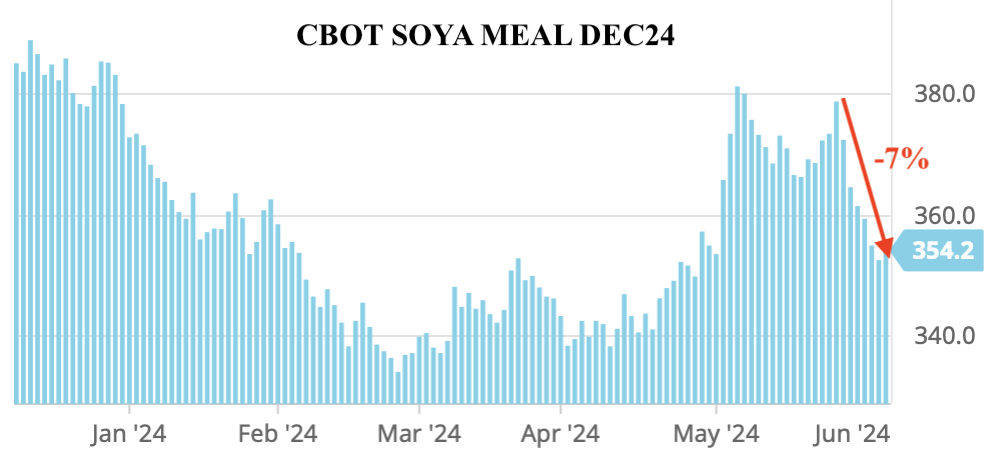

US 🇺🇸 good crop conditions are taking CBOT prices down.

US corn, soya and wheat markets went down +/- 7% in the past week amid ideal growing conditions (soil moisture) and above average planting pace despite rains.

This price consolidation has also affected European OSR and wheat markets. However, we do not expect much further decrease. A price rebound is even likely as Black Sea weather remain adverse (less than 80MT for Russian wheat?) and S. American corn production could be revised significantly down (19MT difference between USDA and local analysts figures).

In that context, the next USDA report, to be published on the 12th June, will be interesting to follow!

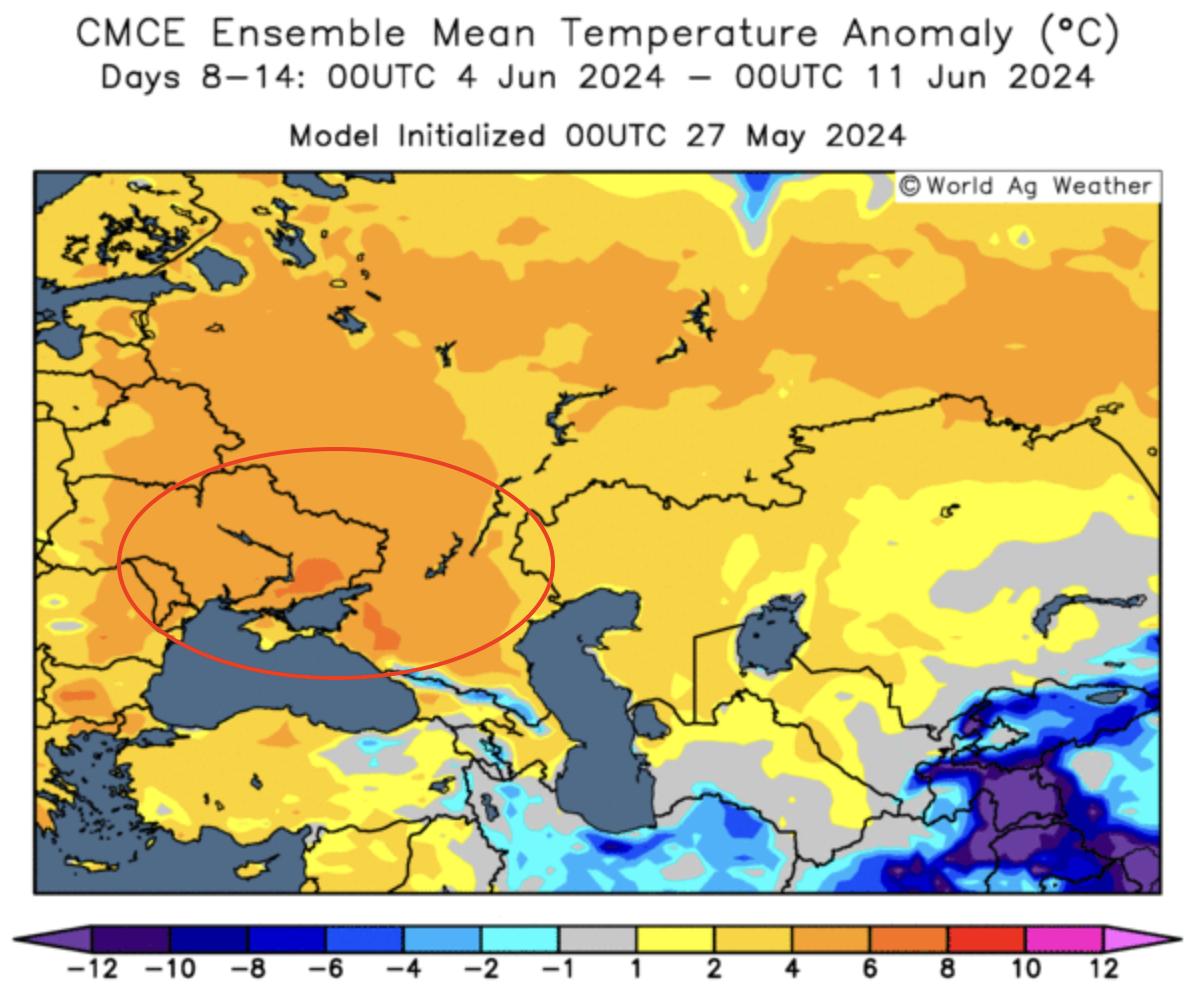

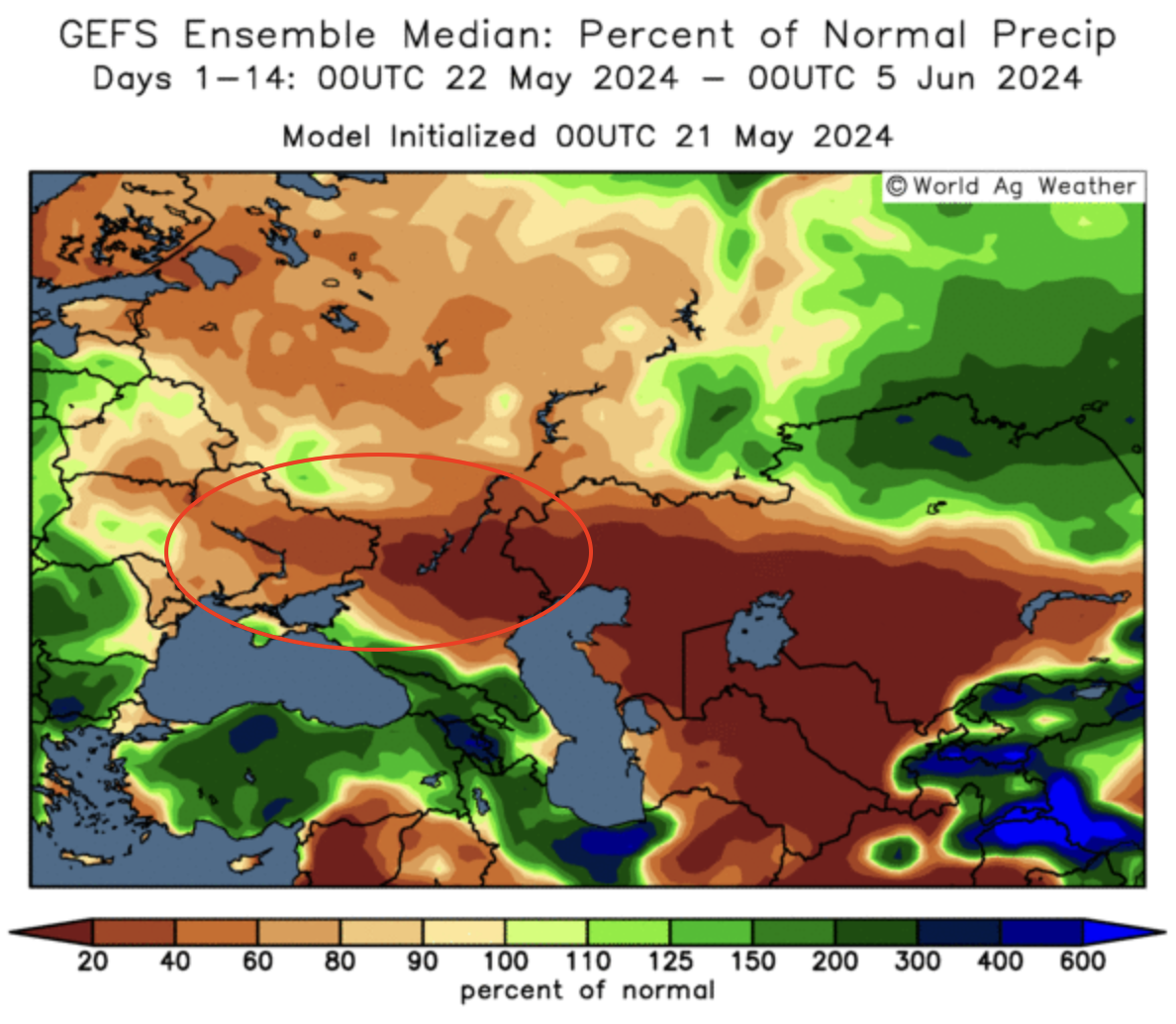

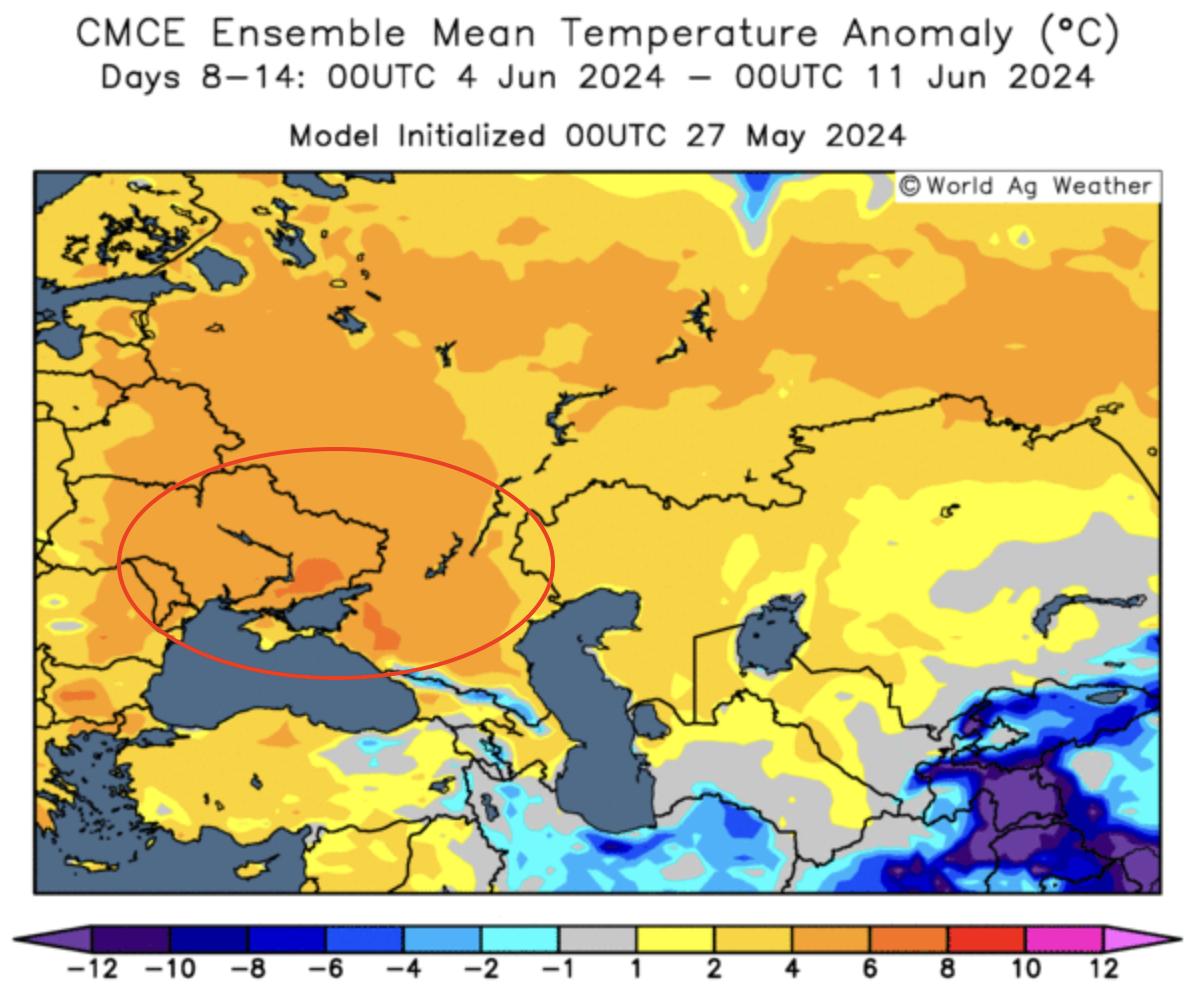

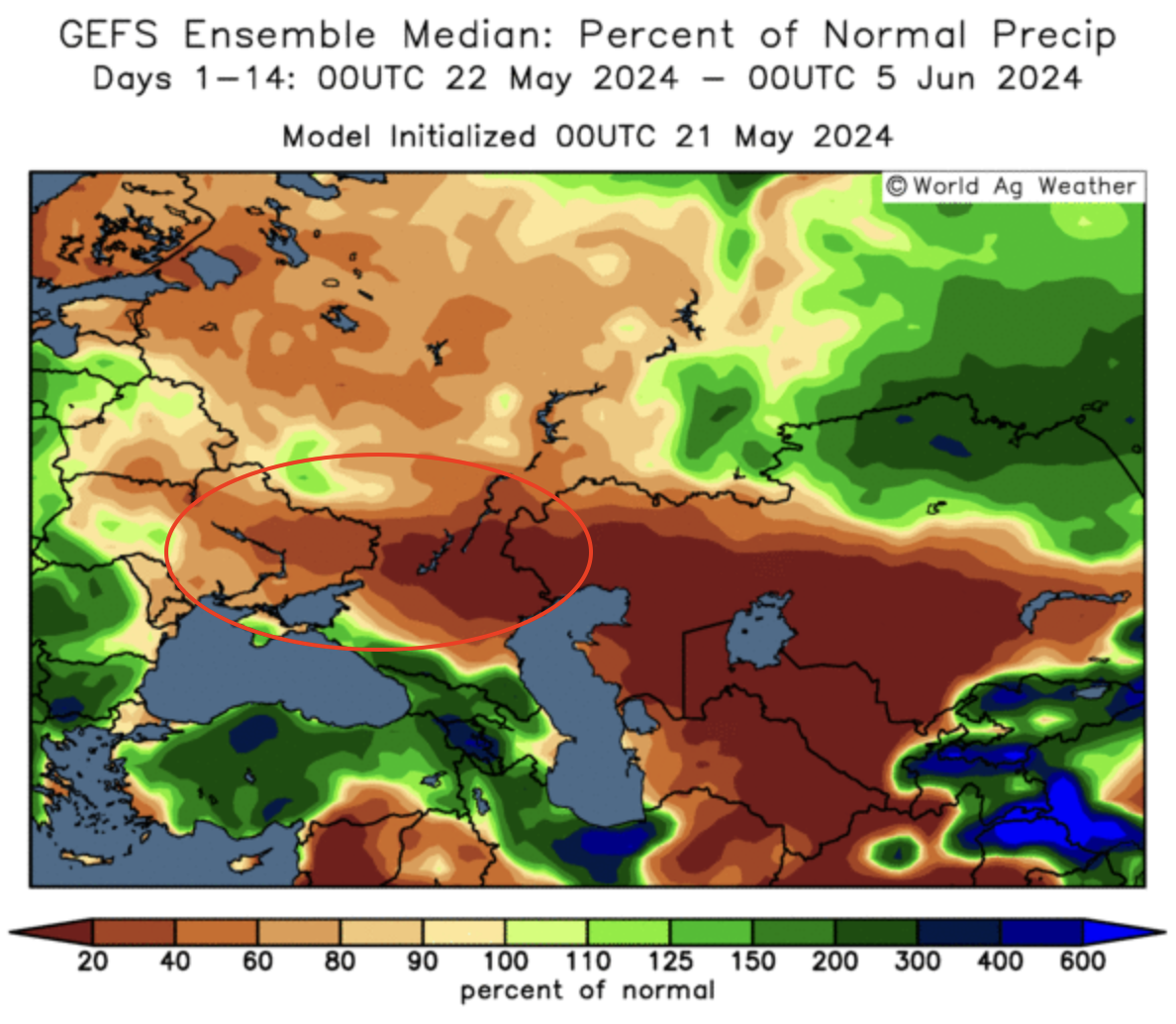

Little/no rain and above normal temperatures for most of Ukraine 🇺🇦 and Russia 🇷🇺.

Black Sea weather forecasts have not improved over the week-end. For the next 2 weeks, until half June, most of Ukraine and Russian key grain areas will remain dry and temperatures will be 4 to 6°C above normal. Maximum temperatures will reach 30 to 35°C.

Markets will probably continue to price some more production drop potentials. We are now looking at low 80s (down from the 94MT initial estimate) for Russian wheat. Will we soon see a production starting with a 7?

Wheat prices at season’s highs again amid Ukraine 🇺🇦 and Russia 🇷🇺 dryness.

Dryness continues to expand in southern Russia and Ukraine wheat areas over the next ten days, with corn germination/development also struggling. Temperatures are also above normal…

There is a kind of panic move on markets and funds are now increasing their long positions (only 2 months ago they were still holding a record short position). Consumers have also been surprised by this sudden change of trend and are running after these rising markets. A worse case wheat scenario is developing. What will happen if Russia and Ukraine face a crop failure? How will Putin react? Last time it happened was in 2010-11. At that time, Russia was exporting only 18MT of wheat. This season they will have exported 50MT!